Payment gateway software

Secure Payment Gateway Integration Solutions

Zero Friction Payments: Process More, Faster

Managing payments shouldn’t create unnecessary friction for your business. If you’re an online commerce company using multiple, disparate payment systems, or if your customers experience failed transactions during checkout, it can lead to abandoned carts and lost sales. We specialize in integrating reliable payment gateways like Stripe, Square, and Authorize.Net directly into your website or app, ensuring smooth, secure transactions for your customers.

We know handling payment processing, maintaining security, and staying compliant with standards like PCI DSS can take valuable time and resources. We aim to simplify this for you—by integrating the right payment solution for your business needs and ensuring everything works seamlessly, so you can focus on running your business.

Our integration services include industry-standard features like SSL/TLS encryption, fraud protection, 3D Secure authentication, and more to safeguard every transaction. We also help ensure you stay compliant with PCI DSS requirements, so you don’t have to worry about security risks or missing regulations.

We handle the technical aspects of payment gateway integration to streamline your payment processes and improve the overall experience for both your business and your customers.

<3 Sec

Transaction Processing Time

50%

Reduction in Payment Failure

10%

Increase in Revenue

Download The Master Guide For Building Delightful, Sticky Apps In 2025.

Build your app like a PRO. Nail everything from that first lightbulb moment to the first million.

When Payments Systems Fail, Your Business Pays The Price

Every delayed payment, failed transaction, and complicated checkout process undermines your brand’s credibility. For businesses running on digital platforms, we take care of critical integrations with reliable, secure payment software directly impacting sales, revenue and customer experience.

Many businesses use outdated payment systems that cause transaction failures, security risks, and lost sales. Without a unified payment infrastructure, you face delays, missed opportunities, and cart abandonment, which can harm customer trust.

We integrate trusted payment gateways like Stripe, Square, and Authorize.Net into your website or app, creating a streamlined, secure, and efficient payment process. Whether it’s credit cards, digital wallets, or other methods, we simplify and secure the experience.

We start by assessing your current payment system, identifying issues like inefficient routing, security gaps, or slow transactions. Then, we customize the integration with Stripe’s SDK, Node.js for the backend, and React.js for the frontend, ensuring a smooth, user-friendly experience.

Example: A retail business integrates Stripe for global payments, allowing customers to pay in their local currency while staying PCI DSS compliant. This integration cuts cart abandonment by 25% and boosts payment success rates by 15%, driving revenue growth.

Payment systems lose revenue when transactions route through suboptimal processors. Static gateway configurations can’t adapt to regional approval rate fluctuations or card network performance changes, costing businesses 12-18% in unnecessary declines.

We implement dynamic routing engines that analyze real-time processor performance, card BIN patterns, and time-based trends. Using AWS Lambda for instant decisions, transactions automatically shift between primary (Stripe/Adyen) and regional acquirers (Rapyd in APAC, Nexi in EU) based on live success rates. Redis caches routing rules for sub-100ms response times.

Imagine an e-commerce site where transactions from customers in the APAC region are routed through a local processor like Rapyd, while transactions from the EU are directed to Nexi. This dynamic routing reduces declines by 20% during high-traffic periods, increasing transaction success rates and revenue.

Basic fraud tools often result in false declines and fail to catch advanced fraud, leading to financial losses. Merchants can lose up to 10x the fraud amount in chargebacks, fees, and lost revenue.

We use machine learning to analyze over 200 data points, such as device fingerprints and checkout patterns, to detect fraud in real time. Our system adjusts fraud detection thresholds based on transaction velocity, ensuring legitimate transactions go through smoothly while flagging potential fraud.

Our fraud protection integrates with Stripe Radar or Signifyd, automatically adjusting thresholds and sending alerts to your CRM via OAuth 2.0-secured APIs. This enables your team to act quickly and stop fraudulent transactions before they cause losses.

For example, imagine your subscription service detecting unusual checkout patterns in real time. Our system adjusts risk thresholds as transactions occur, allowing legitimate payments to go through while preventing fraud, significantly reducing chargebacks and protecting your revenue.

Storing raw card data in-house exposes you to security risks and complicates PCI compliance. We solve this by removing the need to store sensitive data altogether through P2PE encryption and tokenization.

By implementing Thales HSMs for key management, we ensure your security measures are top-notch. Our solution also automates the generation of SAQ-D reports using Terraform, reducing the time and effort it takes to maintain PCI DSS compliance. Tokenized payments flow seamlessly through trusted vaults like Braintree or Adyen, ensuring smooth, secure transactions for your customers while removing you from the compliance burden.

Example: A subscription service replaces sensitive card data with tokenized information, ensuring compliance with PCI DSS without the headache of raw card storage. Payments are securely processed through Braintree’s token vault, simplifying compliance and reducing security risks.

Failed recurring payments are a silent revenue killer. Outdated payment methods, expired cards, and manual recovery drain resources and hurt your bottom line. We handle all of that by automating your billing process.

We create event-driven systems using Kafka or PubSub, with smart retry logic optimized for your customers’ time zones. Our approach includes auto-update prompts for payment details (e.g., expired cards), and we integrate proration engines using Stripe Billing or Chargebee for accurate, flexible billing.

Example: A SaaS business automates subscription renewals with Stripe or Chargebee, triggering automatic prompts for customers to update payment details when cards expire. This keeps subscriptions active, reduces manual follow-ups, and boosts long-term customer retention.

Hidden FX fees and poor conversion rates hurt your international revenue. When customers see unexpected charges at checkout, they often abandon their cart. We solve this with dynamic currency conversion (DCC), giving customers a transparent, local price.

Our solution pulls real-time exchange rates from trusted providers like XE.com or CurrencyLayer. The system automatically routes payments through cost-effective processors while displaying prices in the customer’s local currency based on geo-IP detection.

Example: An online retailer automatically converts prices based on the customer’s location—customers in Europe see prices in EUR, while U.S. customers see USD. This prevents checkout surprises, reduces cart abandonment, and boosts conversions.

Reconciling payments can be a nightmare if you’re running both physical and online stores. Delays in payment processing between in-store and online sales can lead to inventory discrepancies and accounting errors. We integrate your POS systems directly with your e-commerce platform to streamline this process.

We unify systems like Clover and Toast POS with e-commerce platforms like Shopify or Square using a centralized transaction ID. This ensures real-time updates to inventory and financial records without the need for manual intervention.

Example: A retail chain synchronizes in-store purchases with the online system. Whether a customer buys in-store or online, the payment and inventory records update instantly, ensuring accurate stock levels and accounting without manual input.

Standard PCI compliance isn’t enough to protect your business from today’s evolving threats. We design multi-layered security systems that go beyond the basics, using HSMs for key management and quantum-resistant encryption protocols to secure your data.

Our architecture includes runtime application self-protection (RASP) to detect injection attacks and token vaults with format-preserving encryption. This ensures sensitive data like PANs is never exposed, even if a breach occurs.

Imagine a payment system where transaction data is encrypted consistently across all platforms. If a breach occurs, security layers automatically detect and stop injection attacks, ensuring that sensitive payment data, like PAN, is never exposed.

Off-the-shelf payment flows can be rigid and frustrating for customers, affecting your conversion rates. We create custom payment flows tailored to your unique business needs, ensuring a smooth and intuitive checkout experience.

Using React Payment Handlers for browser-based payments and native SDKs for mobile, we build adaptive flows that change based on payment method selection. Our designs prioritize customer experience by minimizing friction, offering one-click guest checkouts, and leveraging progressive disclosure to reduce abandonment.

Example: A customer selects a payment method, and the checkout process adjusts to request only the necessary details. This results in faster checkouts, reduced friction, and fewer abandoned carts.

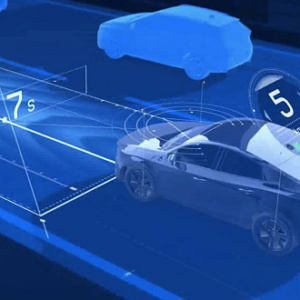

Slow payment processing can directly impact your revenue. Every 100ms of latency decreases conversion rates by 1-2%. We find and eliminate bottlenecks in your payment stack to optimize performance and ensure lightning-fast transaction times.

We conduct a comprehensive performance audit of your payment systems, identifying delays from DNS lookups to gateway response times. Our solution includes Cloudflare Workers for edge computing, HTTP/3 QUIC protocol for faster data transfer, and predictive pre-authorization to start the transaction before the customer clicks.

Example: A customer hovers over the checkout button, and the system pre-authorizes the payment before they click. This reduces checkout delays and improves the overall speed of the transaction, increasing conversion rates.

Generic payment solutions can’t meet the needs of specialized businesses like subscription marketplaces or B2B platforms. We build custom payment systems using Golang for high-volume transactions and Rust for secure processing, offering flexibility that off-the-shelf solutions simply can’t.

Our custom solutions include dynamic settlement scheduling, multi-party escrow systems, and adaptive payment routing, allowing you to tailor the process to your unique business model.

Example: A marketplace customizes its payment engine to handle multi-party transactions, ensuring that funds are securely split between vendors without relying on generic solutions. This provides flexibility and reduces dependency on third-party systems.

For global businesses, failing to offer local currency options can lead to conversion drops of 15-20%. We implement true multi-currency processing, combining real-time data from 160+ central banks with local acquiring partnerships across 38 countries.

We optimize routing based on historical FX spreads, ensuring the best cost-effective path for each currency pair. Our system automatically displays prices in the customer’s local currency, improving conversion rates and reducing FX fees.

Example: An international retailer automatically converts prices to local currencies based on the customer’s location, ensuring the best settlement route. This reduces FX costs and boosts conversion rates by providing a transparent, localized checkout experience.

Industry-Specific Payment Solutions

Your industry’s payment pain points demand custom solutions. We build payment systems that are relatable to your industry and effective for your business.

| Education | Enable secure, automated processing for tuition and course payments, with seamless reconciliation to student systems, ensuring quick and reliable transactions. |

| Fintech | Build a robust payment system that ensures real-time, secure transactions for trading platforms and money transfers, minimizing downtime and maintaining compliance. |

| Retail | Simplify checkout across online and physical stores by integrating a payment gateway that provides real-time inventory updates and faster transaction processing. |

| Agriculture | Facilitate secure, fast payments for equipment leasing and farm product transactions, making financial management easier for agricultural businesses. |

| Energy | Implement secure, compliant payment solutions that handle field operations and royalty distributions while meeting industry regulations and ensuring smooth payments. |

Our Approach To Implementing Payment Solutions

Our proven five-phase methodology first identifies your exact leaks through technical audits, then engineers high-converting payment flows with built-in fraud protection.

We deploy optimized systems without disrupting operations and continuously refine performance. The result: measurable jumps in approval rates, dramatic fraud reduction, and hands-free compliance.

We begin by analyzing your existing payment system to identify pain points—whether it's high transaction fees, cart abandonment on mobile, or issues related to security. Using diagnostic tools, we pinpoint areas where you’re losing revenue and craft a clear action plan with measurable targets for improvement. You’ll receive a detailed roadmap outlining the necessary changes and the expected improvements in your payment system.

We integrate the right payment gateways, such as Stripe for subscriptions or Adyen for global payments, ensuring that transactions are processed smoothly. We create intelligent routing rules that prioritize efficiency, reduce processing costs, and implement tokenization to ease your PCI compliance burdens. You’ll get a secure and optimized payment system tailored to your needs, with built-in fraud prevention.

Our team works with technologies that fit your business needs, ensuring a smooth integration process. We rigorously test the payment system under real-world conditions—simulating peak sales volumes and potential fraud attempts—to ensure stability and security. Your payment gateway integration is stress-tested and fully secure, ready to handle both high traffic and sophisticated fraud attempts.

We integrate the new payment system without disrupting your ongoing transactions. Using parallel processing, we shift the transaction load gradually, ensuring a smooth transition. The full transition is completed with minimal downtime, guaranteeing no revenue loss. It results in seamless payment gateway integration with no disruptions to your live payments.

After launch, we continuously monitor payment transactions, analyzing performance and fine-tuning routing rules to ensure optimal results. We handle compliance updates and proactively address emerging threats, scaling the system during peak traffic periods. A self-optimizing payment system that evolves with your business needs and keeps you compliant with minimal effort.

Recover Your Lost Revenue Opportunity in 24 Hours

Enterprise-Grade Payment Infrastructure

| Layer | Tools & Technologies | What It Solves |

| Core Processing | Stripe, Adyen, Braintree, Rapyd | Global transactions with optimal approval rates |

| Fraud Prevention | TensorFlow, Signifyd, Rules Engine (Drools) | Blocks fraud without declining good customers |

| Compliance | Thales HSMs, Tokenization, Qualys PCI ASV | Reduces PCI scope and automates audits |

| Performance | Redis, Kubernetes, AWS Lambda | Handles Black Friday-level traffic spikes |

| Data & Analytics | Snowflake, Datadog, Splunk | Real-time transaction monitoring & optimization |

| Integration | FastAPI (Python), Express.js (Node), NGINX | Secure, scalable connections to your systems |

Behind the Success: Our Case Studies

When Payments Work Right, Business Thrives

For forward-thinking enterprises, payment systems should be invisible – seamlessly converting opportunities into revenue. At Codewave, we engineer gateway integrations that simply work.

See how we’ve helped businesses like yours:

- Turned payment friction into competitive advantage for global retailers

- Transformed recurring billing from headache to hands-off for SaaS innovators

- Built fraud defenses that protect without punishing for financial leaders

We transform companies!

Codewave is an award-winning company that transforms businesses by generating ideas, building products, and accelerating growth.

Frequently asked questions

Codewave’s payment integration solutions are highly customizable. We use a design thinking approach to tailor our solutions to your specific business needs, ensuring seamless integration with your existing systems and optimal user experience for your customers.

We prioritize security in all our payment integrations. Our solutions comply with PCI DSS standards and incorporate advanced encryption, tokenization, and fraud prevention measures. We also stay up-to-date with the latest security protocols to ensure your transactions remain protected.

The timeline for payment integration varies depending on the complexity of your project and specific requirements. Generally, our process takes 4-8 weeks from initial consultation to launch. We provide a detailed project timeline during our initial discussions to ensure transparency and efficient delivery.

Codewave supports a wide range of payment methods, including credit/debit cards, digital wallets, bank transfers, and alternative payment methods. We can integrate solutions that support multiple currencies, enabling you to serve customers globally.

Our pricing is customized based on the scope and complexity of your project. We offer flexible pricing models, including fixed-price projects and time-and-materials arrangements. Contact us for a personalized quote tailored to your specific needs.

We offer comprehensive post-integration support, including maintenance, updates, and troubleshooting. Our global team ensures 24/7 support availability, and we provide regular system updates to keep your payment integration secure and up-to-date with the latest features.

Yes, our payment solutions are designed to integrate seamlessly with a wide range of e-commerce platforms, CRM systems, and other business software. We have experience working with popular platforms and can also create custom integrations for proprietary systems.

Codewave stays current with global payment regulations and standards. Our team of experts ensures that all integrations comply with relevant laws and regulations in your target markets, including GDPR, PSD2, and local payment processing rules. We also provide guidance on maintaining compliance as regulations evolve.