Insurance Software Solution

P&C Insurance Software Solutions

Smart Insurance Protection for Property & Casualty

The insurance industry is under pressure like never before – slow claims, frauds, disconnected systems, and outdated processes frustrate customers, resulting in lost trust and cancellations. When expectations like faster claims processing and seamless experiences aren’t met, customer loyalty weakens, churn increases, and growth slows.

Automate claims management, simplify underwriting and policy administration—all while providing delightful customer experiences. We architect and build scalable cloud-based platforms with AI-ML improving fraud detection, predictions & decision-making.

Let Codewave help you stay ahead of the curve by delivering smarter, faster, and more reliable P&C insurance solutions.

50%

Faster Claims

100%

Billing Accuracy

2x

Fraud Detection Accuracy

Download The Master Guide For Building Delightful, Sticky Apps In 2025.

Build your app like a PRO. Nail everything from that first lightbulb moment to the first million.

Make claims handling fast, accurate, and simple with a custom P&C insurance claims software. We use AI to automate claims intake, reduce manual data entry and speed up the initial process. Machine learning helps us to flag inconsistencies for claims verification— improve the accuracy of assessments and reduce fraud. Cloud infrastructure scales to handle more claims as your business grows for smooth processing even during high-demand periods.

For example, when a customer submits a car accident claim, our system automates verification and assessments, reducing decisioning/approval time by 50%. This results in quicker decisions, higher customer satisfaction, at lower operational costs.

Automate the policy management lifecycle, from issuance to renewal. We use Robotic Process Automation (RPA) for policy creation and updates, eliminating manual data entry and speeding up the process. We ensure renewals are completed on time to reduce risk of missed opportunities. For data management and storage, we rely on cloud-based platforms like AWS for secure access to policy information and scalability as your business grows.

For example, when a customer requests a policy renewal, the system automatically updates their coverage details, calculates the premium, and generates a renewal document. This reduces processing time by half, ensuring the customer gets their updated policy quickly and accurately.

Manual processes and insufficient data shouldn’t delay underwriting decisions–with AI assisted automation for risk assessment you can connect the dots, validate & make sense of data, and make faster, informed decisions.

We use automated systems to collect data from customer records, claims history, IoT devices, and even external sources–geospatial and socioeconomic datasets. TensorFlow and PyTorch analyze data, uncover patterns, and assess risks accurately.

SpaCy and AWS Comprehend analyze legal documents and claims to provide clear insights. Blockchain secures underwriting records to keep data tamper-proof and transparent. IBM Watson OpenScale provides clear explanations of AI decisions, enabling underwriters to make confident choices.

We integrate policy management systems with payment gateways to automate invoicing, premium collections, and claims payouts. AWS offers secure, real-time data management for all financial transactions to be processed accurately and without delays. This reduces manual intervention and enhances operational efficiency.

For example, when a customer’s health insurance premium is due, the system generates the invoice with the correct amount and sends it to the customer. The payment is processed through a secure gateway and confirmed within seconds.

Nearly half of all customers (46%) expect a response to their queries within 4 hours. Delayed follow-ups or slow replies lose customers’ trust.

We integrate CRM systems with policy management to get a 360-degree view of your customers’ profile and journeys. We use Salesforce to automate follow-ups, so no customer query is left unanswered, while HubSpot helps trigger notifications at the right moments, improving customer engagement. Intercom enhances real-time communication, providing instant responses and driving better customer retention.

For example, when a customer submits a car insurance claim, the system updates their CRM profile with the claim details — the date, damage type, and repair estimate, does an initial analysis of the customer history and simplifies further steps that need holistic understanding and action.

70% of financial losses stem from poorly managed risks. Risk management software identifies, assesses, and mitigates risks with precision.

We use AI to analyze vast amounts of data and identify potential risks in real-time, ensuring you’re always ahead of the curve. Predictive analytics helps spot patterns and trends to reduce chances of future claims and minimize potential losses. Catastrophe modeling tools help simulate extreme events, such as floods and earthquakes, to assess potential exposure and optimize coverage strategies.

For example, when a policyholder submits multiple high-value claims for property damage, the system automatically flags the case as high-risk. AI analyzes the claim history, detects discrepancies in the supporting documents and recommends further investigation.

Policyholder satisfaction hinges on easy, convenient access to their policy information. We enable self-service maintenance where policyholders can interact with Video AI Bot Agents, get information or perform things like updating addresses and modify preferences.

Salesforce helps to manage policyholder data, mobile-friendly online forms for quick updates, and AWS for secure, scalable data storage. Twilio and Zendesk ensure consistent, personalized communication across phone, online, mobile, and mail channels, providing a unified experience for your customers.

Insurance Software That Adapts to Your Business

We know your daily hurdles— managing policies, processing claims, or delighting customers.

Custom Solutions, Not Templates

We don’t rely on generic templates. We use a design-thinking approach to understand your business workflows, challenges, and goals. We use tools like Miro and Lucidchart for journey mapping, service blueprints and identify pain points.

We don’t recommend any technology without a purpose & alignment to your business KPIs. For example, machine learning helps us to improve fraud detection, ensure accurate and efficient claim processing.

Collaboration That Gives You Control

Collaboration is key, and we keep you involved throughout the solution development process. Jira, Trello, and our internal system, Glue let us manage backlogs, tasks, track progress, and ensure everyone is aligned. Our cNPS team ensures that your feedback is gathered every milestone and incorporated as the product evolves based on your needs and priorities.

Agile Development for Flexibility

Agile methodology allows us to adapt quickly to your evolving needs. With scrum rituals and regular sprints, we deliver incremental business value to your business. This ensures that the final product meets both market demands and user expectations while reducing time-to-market.

Proactive Performance Optimization

We ensure your P&C insurance software systems run smoothly under varying conditions. AWS for cloud infrastructure and New Relic for performance monitoring, to proactively optimize the system for speed, reliability, and scalability. This allows you to manage high volumes of data and transactions without sacrificing performance.

Design Thinking

Our approach starts by understanding user pain points through persona development and user journey mapping. We design intuitive features that address real user needs. For example, we streamline claims submission processes by identifying bottlenecks and removing friction– faster claims resolutions and better user satisfaction.

Intelligent Automation with Human Oversight

We take a different approach with automation. Instead of fully relying on AI, we combine it with human oversight to ensure quality and accuracy. For instance, AI quickly analyses cases, risks and informs claim processing, assisting your team to review risks before approval. This keeps things moving fast without sacrificing the human judgment needed to avoid mistakes or fraud.

Let’s Make Your Insurance Processes a Breeze.

Insurance Solutions for Every Industry

Industry | How it works |

Simplify policy management and claims processing for health insurance, ensuring compliance with regulatory standards and efficient claims handling. | |

Optimize risk management and coverage for energy companies, including renewable energy projects, utilities, and energy infrastructure, with seamless policy management and claims automation. | |

Better risk assessment and compliance for financial services with automated underwriting, claims management, and fraud detection tools, ensuring security and accuracy in financial policies. | |

Automate claims handling, vehicle, freight, and cargo insurance policies, optimizing risk management and improving customer service for transportation businesses. |

We transform companies!

Codewave is an award-winning company that transforms businesses by generating ideas, building products, and accelerating growth.

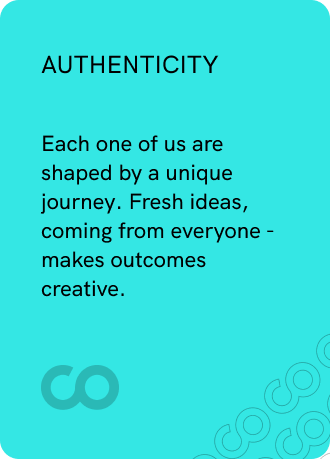

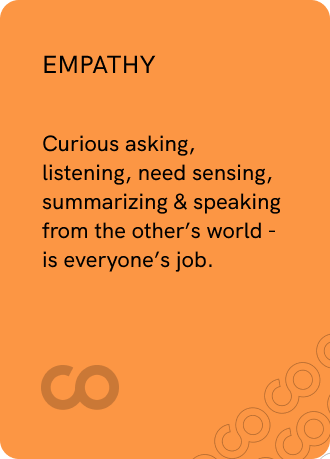

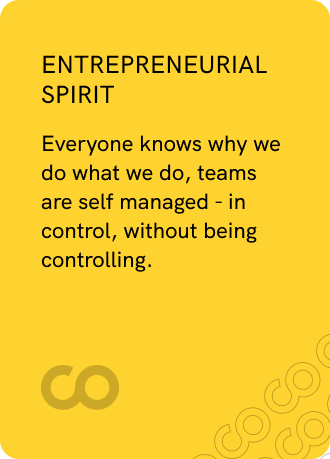

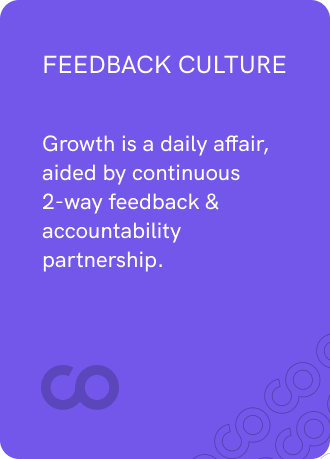

What to expect working with us.

Frequently asked questions

P&C Insurance Software is a specialized software solution designed to help insurance companies manage their property and casualty policies, claims, billing, and customer interactions efficiently. It automates key processes and enhances customer experience.

Our P&C software automates claims intake, verification, and approval, reducing manual errors and processing time. It uses AI-driven tools for fraud detection and predictive analytics, improving decision-making and accelerating claim resolution.

Yes, by automating repetitive tasks such as claims processing, billing, and policy management, the software reduces manual work, minimizes errors, and improves operational efficiency, ultimately reducing overhead costs.

Absolutely! Our P&C insurance software is fully customizable to meet the specific needs of your business. Whether it’s for policy creation, claims management, or customer service, we tailor the solution to fit your unique workflows.

Our software is built with high-level security features, including data encryption, multi-factor authentication, and cloud-based infrastructure to ensure that all sensitive data, such as customer information and financial transactions, is fully protected.

The software empowers policyholders with self-service portals, allowing them to easily manage their policies, file claims, and make payments. It provides seamless omnichannel communication, ensuring that customers have a consistent experience across phone, online, and mobile platforms.

Yes, our P&C insurance software is built on cloud-based platforms that allow for seamless scalability. Whether you’re handling 1,000 or 100,000 policies, the software adjusts to meet your growing business needs.

Implementation time depends on the complexity of your needs and the level of customization required. On average, it takes between 3 to 6 months to deploy and fully integrate the software into your business operations.

Yes, we provide ongoing support and maintenance services. This includes software updates, troubleshooting, and user training to ensure that your systems remain up-to-date and optimized for performance.

Most in demand

Comprehensive Software Consulting Services

IT Architecture Services for Enterprises

Cloud Software Solutions

Automated Invoice Processing Cloud Service Solutions

Comprehensive Backend Development Services and Solutions

LMS Development Services for Modern Learning Needs

Database Migration Service for Enterprises

AI OCR Solutions for Accurate Document Processing

Enterprise Blockchain Development Services

Cross-Platform Mobile App Development Services

Custom Enterprise Application Development Services

Custom E-Commerce Solutions for Enterprises

Travel Technology Solutions and Services Management

Global Design and Innovation Consulting Services

LLM in Corporate Compliance and Risk Management

Services in Software Development

Travel Technology Solutions and Services

Generative AI Consulting and Strategy for Business Innovation

Application Operations and Management Services

Secure, Reliable Cloud Application Modernization Services

Global Design and Innovation Consulting Services

Enterprise Cloud Consulting & Implementation Services Solutions

Ecommerce Web Design & Development Services

Trusted, Unified Xamarin App Development Services You Need

Custom EHR/EMR Integration Services for Connected Healthcare

Cyber Security Consulting Services for Scalable Resilience

AI and Data Analytics Services Solutions

Enterprise App Development Services

Business Intelligence and Data Analytics Solutions

Convert Your Website into a Mobile App for Android and iOS

Managed Healthcare IT Services and Solutions

Custom .NET Software Development Services & Solutions

Website Design and SEO for Medical Practices and Doctors

Big Data Analytics Solutions & Services

IOT Product Development Services for Faster Decision Making

Cloud-Based E-commerce Solutions and Platforms

Custom Financial Software Development Solutions

Enterprise Automation Solutions and Services

Power Up Digital Change with Strategic Design Thinking Workshops

Design Thinking-Driven Strategic Digital Transformation Blueprint

Generative AI Development Platform

Information Technology Strategy and Consulting Services

Product Design and Development Services

Custom Responsive Web Design Services

Magento eCommerce Development and Design Services

Transportation and Logistics IT Services and Solutions

Decision Intelligence Strategy

Automation for Operational Efficiency

Digital Talent Transformation

Integrated CX And UX Design For Delight

Digital Transformation ROI Measurement

Digital Core Modernization

Cloud Migration Services

AI Accounting Software

Software Product Development Services

Decentralized Finance (DeFi) Development Solutions and Services

Startup Software Development Services

Django Development Company for Scalable Web Solutions

HIPAA Compliance and Advisory Services Solutions

Drupal Development Services

Business Analytics Services

Telemedicine Software Development Services

Support and Maintenance Services for Mobile and Web Applications

Cryptocurrency Development Services and Solutions

AI Testing Services / AI-Powered Testing Services

IT Infrastructure Services

ASP.Net Software Development Services

Retail IT Solutions and Services

Managed Application Services

Data Warehouse Services

Data Science Consulting

Agentic AI Product Design And Development Services

Healthcare Mobile App Development Services

CRM Consulting and Implementation Services

Custom Database Development Services and Solutions

Transportation and Logistics Software Development Solutions

Secure Payment Gateway Integration Solutions

Data Management Services

Java Software Development Services

PHP Development Services

Fast, Scalable, Secure Node.js App Development

Power BI Consulting Services

IT Project Management Services

NFT Token Development Services

DevOps Consulting and Services

Web Data Mining Services

Front-End Development Services

Managed Services for E-commerce Success

Website Redesign Services for Strengthening Your Web Presence

Custom SaaS Development Services

Custom CMS Web Development Services

NFT Marketplace Development Services

Smart Contract Development Services

Oil and gas IT services

AI Audit for Startup Companies | Best Website Audits

PrivateGPT Development Services

Swift iOS App Development Services

Web3 Development Services Company

AI-Native Product Design and Development Services

Personalized Learning with AI for Education

Microsoft Dynamics 365 Customer Service with AI

Energy Management Software Solutions Platform

Human Machine Interface Software Development Service

Education Software Development Services

Retail Software Development Services and Solutions

DEX – Digital Employee Experience Software Services

Decentralized Exchange Development (DEX) Company

Offshore Software Testing Services

Backend Development Services and Solutions

Travel and Hospitality Software Development Services

Fintech Software Development Services

Data Visualization Consulting Services

Digital Solutions For Agriculture and Software Services

Payment Gateway and Software Development Services

B2B Travel Software and Booking

MEAN Stack Development Services

24/7 Managed NOC Services

Database Migration Service

Design-Led AI Consulting for SMEs and Startups

AI Solutions Development Services

P&C Insurance Software Solutions

MLOps Consulting Services

Generative AI Services and Solutions

Conversational AI Platform Development

AI and Analytics for Retail Solutions

Artificial Intelligence Video Chatbot Services

Digital-First Banking IT Services

Golang Development Services

MVP Development Services

eLearning Software Development

Agile Software Development Services

Data Warehouse Consulting and Management Services

IT Services Management Consultancy Services

Learning Management System Consulting Services

iOS App Development Services Company

Ecommerce Services

Marketing Automation and CRM Solutions

Industrial IoT Solutions and Services

Healthcare Data Analytics Solutions

Cryptocurrency Wallet Development

Digital Strategy Consulting Services

B2B Portal Development

Embedded Technology Innovation

Process Automation

XR Application Development

Artificial Intelligence and Machine Learning Consulting Services

Cloud Infrastructure

Blockchain Implementation

Flutter App Development

Angular Development

Mobile Application Testing Tools and Services

Penetration & Vulnerability Testing

QA Testing Services

Reactjs Development

Team Augmentation

Automation Testing

Web App / Portal Development

Python Development

IT Consulting

Custom Software Development

Branding

ReactNative App Development

Web and Mobile App UX – UI Design Services

UX & UI Design

Android App Development

Mobile App Development

Idea to Product

IoT Development

Data Analytics Development

GenAI Development

AI/ML Development

Design thinking

Process Automation

Digital Transformation

Customer Experience Design