Custom Financial Software Development

Custom Financial Software Development Solutions

Can Your Financial Software Keep Up With Customer Trust?

Financial institutions relying on outdated or fragmented software often face slow transactions, manual reconciliation errors, and increasing compliance risks. These inefficiencies raise operational costs and expose your business to regulatory penalties and reputational damage. When customer trust hinges on speed and accuracy, even minor delays in settlement or reporting can have a significant financial impact.

To bridge this gap, Codewave builds custom financial services software designed for high accuracy, security, and regulatory compliance. From real-time payment processing to automated reconciliation and fraud detection, our solutions are designed to minimize risks and enhance efficiency across financial operations. We integrate technologies like blockchain for immutable audit trails and AI/ML for fraud pattern recognition, enabling financial businesses to scale with confidence.

By implementing ISO 27001-aligned security frameworks and adopting tools such as TensorFlow for anomaly detection or Hyperledger for transaction transparency, we ensure your systems meet compliance standards while inspiring trust among your clients and stakeholders.

With our services, you can expect measurable outcomes, such as:

100%

Secure Transactions

3x

Faster Payment Reconciliation

60%

Reduction in fraud incidents

Download The Master Guide For Building Delightful, Sticky Apps In 2025.

Build your app like a PRO. Nail everything from that first lightbulb moment to the first million.

From Manual Workflows to Intelligent Financial Software

Struggling with rigid banking cores, manual workflows, and fragmented payment systems? Our custom-built financial software platforms modernize operations, cut compliance risk, and deliver real-time transparency.

Traditional core banking platforms often trap institutions in rigid processes and outdated infrastructure. These systems are expensive to maintain, struggle to scale, and are unable to keep up with changing regulatory standards.

We build custom, API-first banking platforms that unify account management, loans, deposits, withdrawals, currency exchange, and remittance into a centralized system. We architect these platforms using Kubernetes microservices for independent scaling, PostgreSQL and Oracle for ACID-compliant ledgers, and Kafka for event-driven reconciliation.

Our designs also integrate real-time reporting modules and role-based access controls, ensuring transparency for auditors and compliance teams. The result is a system that performs daily banking operations effortlessly and adapts quickly to new products and evolving regulations.

Example: Banks, depending on monolithic reconciliation modules, often wait days for settlement. By replacing batch jobs with Kafka-powered event processing and PostgreSQL-backed ledger management, they can reduce settlements from 48 hours to near real-time. This, in turn, can improve liquidity planning and customer confidence.

Customers increasingly demand around-the-clock digital access, yet many existing online platforms are static, insecure, and hard to personalize.

Codewave designs custom internet and mobile banking applications that prioritize security, speed, and usability. We build personalized dashboards and PFM (Personal Financial Management) tools using AI/ML recommendation models, and integrate biometric authentication APIs for secure access. Our experts also enable WebRTC-based conversational banking for real-time engagement.

By adopting cloud-native architectures, we ensure that performance remains consistent even under heavy loads. At the same time, modular APIs make it easy to extend services to IoT devices, such as wearables and voice assistants. These systems give customers confidence to manage their money anywhere, anytime, while helping banks build loyalty through richer digital experiences.

Example: A regional digital bank experienced a dip in customer engagement as users found its app repetitive and inconvenient. After implementing biometric logins, AI-driven savings insights, and real-time chat through WebRTC, they will be able to increase daily active usage manifold, while also significantly improving the adoption of savings products.

Financial institutions often treat CRMs as generic data repositories, which limits their impact on growth. Off-the-shelf solutions don’t capture the complexity of banking interactions, from onboarding to loan servicing.

We customize Salesforce and Dynamics 365 to align with financial workflows, integrating them directly with core banking systems, mobile apps, and call center platforms. Furthermore, we enhance CRMs with AI-powered lead scoring and nurturing, journey mapping, customer profiling, and document automation, ensuring that sales and service teams work on real-time, unified data.

Dashboards built with Power BI and Tableau give executives visibility into customer lifetime value, churn indicators, and campaign performance. Instead of fragmented records, you get a single, intelligent system that turns customer data into an actionable strategy.

Example: A retail bank was losing high-value loan leads because manual follow-ups took several days. After connecting Salesforce with their loan origination system and applying AI-driven prioritization, they will be able to reduce response times from three days to less than thirty minutes. Moreover, they’ll see a rise in loan conversions.

Banks collect massive volumes of customer, transaction, and channel data, but outdated reporting often leaves leaders with static or delayed insights.

Our experts develop analytics pipelines that transform raw data into real-time intelligence for more thoughtful decision-making. We utilize Spark-based ETL workflows to process high volumes, TensorFlow models to predict credit, market, and liquidity risks, and Power BI or Looker dashboards to give executives live visibility. Every system is built with encryption, lineage tracking, and role-based access to meet strict compliance standards.

Our solutions include customer analytics (segmentation, churn, and cross-sell effectiveness), channel analytics (branch traffic, clickstream behavior, and mobile feature adoption), marketing analytics (campaign ROI and product uptake), and performance analytics (sales efficiency and branch profitability). With this unified view, banks can reduce risk, optimize operations, and identify new growth opportunities.

Example: A lender facing rising defaults was unable to identify high-risk borrowers until it was too late. With a TensorFlow-driven credit-risk model trained on historical borrower behavior and integrated into Spark pipelines, the lender will be able to flag at-risk customers months in advance. This will help reduce default rates.

Manual checks, fragmented borrower interactions, and inconsistent risk evaluation often slow loan origination and underwriting. These inefficiencies inflate costs and create compliance gaps.

We build custom loan origination systems, scoring engines, and debt collection platforms to automate and streamline the lending lifecycle. We design configurable borrower portals for consumer, commercial, and small business loans using React or Angular frontends and secure Node.js or Java backends. Applications and documents are fed into a single system of record powered by PostgreSQL databases and Kafka pipelines for real-time syncing.

Approvals combine rule-based decision engines with ML scoring models built in TensorFlow, ensuring speed and accuracy. E-signature, e-delivery, and e-closing tools such as DocuSign and Adobe Sign APIs enable a fully digital onboarding process. Each system includes audit-ready logs and compliance modules to meet regulatory requirements, resulting in faster approvals, reduced origination costs, and improved borrower trust.

Example: A microfinance provider needed a faster way to evaluate applicants across multiple regions. By implementing a custom loan origination system with ML-driven scoring, automated workflows, and e-signature integration, they’ll be able to reduce loan approval times, cut origination costs, and improve customer satisfaction.

Wealth managers face constant pressure to deliver real-time transparency, meet compliance standards, and optimize portfolios; yet, manual workflows surrounding reporting, accounting, and market analysis often hinder their progress.

We build custom wealth and investment platforms that automate these processes, providing both advisors and investors with actionable insights. Our portfolio optimization systems use Python-based analytics, ML models, and Financial Information Exchange (FIX) API data feeds to forecast markets, assess volatility, and rebalance risk dynamically.

We also design investment calculators for responsive web and mobile interfaces to project profits and losses, estimate position sizes, and model returns required to achieve specific goals. On the back office side, our accounting software eliminates manual record-keeping, payouts, and reporting, with blockchain-ledgers providing an unalterable audit trail and smooth ERP integration.

For investors, we create secure self-service portals that include onboarding, account management, transaction history, and real-time dashboards. These features provide transparency and personalized goal tracking. On the trading front, we engineer online platforms and mobile apps connected to exchanges via FIX/DMA, complete with brokerage and hedging systems, as well as support for algorithmic trading using ML-driven execution engines.

Example: A wealth management firm spent several days each month manually preparing portfolio statements. By automating reporting pipelines with Python and creating blockchain-backed investor portals, they can reduce preparation time, freeing advisors to spend more time on client strategy and engagement.

Payments are one of the most sensitive areas in finance, where speed, scalability, and fraud prevention must coexist. Yet, many SMEs still rely on fragmented systems across billing, invoicing, wallets, and fraud detection, which creates inefficiencies.

We engineer billing engines and BNPL platforms on microservices-based, cloud-native architectures. This includes integrating Stripe, Razorpay, and global payment APIs for smooth credit card processing, recurring payments, and cross-border remittances. Our invoicing systems are designed to handle multi-entity, multi-currency workflows with built-in tax logic. Furthermore, we develop mobile wallets and P2P apps with React/Flutter frontends and Node.js/Java backends to handle peer-to-peer transfers, contactless checkouts, kiosk transactions, and loyalty integrations.

All solutions are PCI DSS-compliant, integrate with Stripe and Razorpay APIs, and use TensorFlow-based anomaly detection for real-time fraud prevention. The result: payments that are fast, secure, compliant, and customer-centric.

Example: A payment services provider faced persistent chargeback fraud that damaged trust. After deploying ML-based fraud detection, they can reduce the number of fraud incidents. This, in turn, will help restore customer confidence and reduce operational losses.

Don't let compliance gaps or slow systems drain revenue and customer trust.

Book your strategy session today

The Codewave Approach to Future-Proof Financial Software

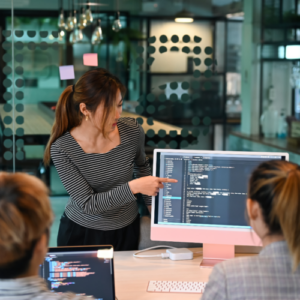

We’ve seen many financial institutions struggle with slow, fragmented, and non-compliant systems. That’s why we take a focused approach by understanding your processes, designing secure and scalable software, and ensuring smooth integration.

We begin by engaging your key stakeholders to conduct thorough requirements gathering and business needs analysis. Using collaborative platforms like JIRA and Confluence, we map out detailed financial workflows, including transaction processing, portfolio management, and regulatory reporting. We also identify bottlenecks, including data inaccuracies, settlement delays, and compliance gaps.

Our project managers apply agile methodologies to create detailed and transparent plans, emphasizing the prevention of scope creep and regular progress reviews. Cost estimates take into account integration with legacy core banking systems, market data APIs such as FIX, and compliance requirements.

This phase establishes a realistic foundation for the success of financial custom software development.

Our solution architects craft a modern, cloud-native architecture that utilizes containerization with Docker and orchestration via Kubernetes to ensure scalability, fault tolerance, and efficient resource utilization. Microservices isolate core functions, such as payments, risk scoring, and compliance reporting, for independent scaling and updates.

UI/UX teams utilize Figma and Adobe XD to create financial dashboards, portfolio views, and transaction workflows that are designed for straightforward interpretation and regulatory traceability. This includes designing dashboards and workflows that simplify complex financial data for both advisors and customers. Prototypes help ensure interfaces accommodate audit trails, multi-factor authentication, and data privacy.

Our experienced developers utilize React or Angular frameworks to deliver dynamic, responsive frontend applications that facilitate intuitive user interactions across desktop and mobile devices.

Backends utilize Node.js or Java Spring Boot to process large volumes of transactions securely and enforce business logic, such as trade validations, credit checks, and AML controls. To handle critical transactional data, we deploy PostgreSQL or Oracle databases, ensuring precise ledger management.

Integration is also a key focus. We connect your custom financial software with existing business systems, financial APIs such as FIX, and payment gateways like Stripe and Razorpay, as well as emerging technologies including blockchain frameworks (Hyperledger Fabric, permissioned Ethereum) for transparent, tamper-evident record-keeping.

We utilize Git for source control, combined with Jenkins or GitLab CI, to automate builds and tests. This approach reduces human errors, speeds up releases, and ensures consistent, high-quality code deployment.

Recognizing that financial applications require impeccable accuracy and security, we employ a dual approach that combines automated and manual testing. Automated Selenium and JUnit tests cover transaction flows, account reconciliations, and reporting outputs. Expert testers conduct manual exploratory testing to identify usability and edge-case issues.

Security is rigorously assessed using OWASP ZAP and Burp Suite to simulate attack vectors and identify vulnerabilities. Performance and load testing simulate peak user scenarios such as end-of-day batch processing or market openings to ensure system responsiveness.

All testing activities are integrated into a CI/CD pipeline, enabling rapid feedback loops. Additionally, we conduct regulatory compliance audits to verify adherence to industry requirements such as PCI DSS and regional BFSI guidelines.

Deployment is managed through Kubernetes, enabling rolling updates and zero-downtime releases. We utilize Prometheus and Grafana for real-time performance tracking, alerting teams to bottlenecks or failures immediately. Our deployment team coordinates closely with your IT personnel to ensure a smooth transition, including comprehensive on-site or remote corporate training sessions delivered via LMS platforms like Moodle.

These are supplemented with detailed Confluence documentation, which includes compliance checklists and disaster recovery protocols. This combination empowers your staff to operate and manage the system confidently. The rollout plan also includes staged user acceptance testing (UAT) to gather feedback and address issues before launch.

Post-deployment, we provide end-to-end maintenance, incorporating scheduled updates for security patches, performance improvements, and functionality enhancements. We use monitoring tools such as Datadog to track application health and PagerDuty for real-time incident response. Our dedicated support teams operate with clear SLAs, ensuring rapid bug resolution and system availability for crucial issues affecting money movement or client data.

Moreover, we conduct periodic compliance reviews to incorporate evolving regulatory standards, safeguarding your ongoing legal standing. Additionally, our knowledge management initiatives, including collaboration tools such as Slack and Microsoft Teams, as well as regular knowledge-sharing sessions, ensure consistent knowledge transfer. This approach maximizes the longevity and accuracy of your financial software investment.

The Technology Behind Trusted Financial Systems

| Service | Tech Stack |

| Cloud-Native Architecture | Kubernetes, Docker, AWS EKS, Azure AKS, Google GKE |

| Frontend Development | React, Angular, Vue.js, HTML5 |

| Backend Development | Node.js, Java Spring Boot, .NET Core, Python, PHP |

| Databases & Ledgers | PostgreSQL, Oracle, MySQL, AWS RDS, Microsoft SQL Server, MongoDB |

| API Integration & Management | RESTful APIs, GraphQL, FIX Protocol, Apache Kafka, MuleSoft |

| Blockchain & Distributed Ledger | Hyperledger Fabric, Ethereum (Permissioned) |

| Payment Gateway Integration | Stripe API, Razorpay API, PayPal API |

| AI & Machine Learning | TensorFlow, PyTorch, Scikit-learn |

| Automated Testing | Selenium, JUnit, Postman, OWASP ZAP |

| Security & Compliance | PCI DSS, GDPR Compliance Tools, AWS KMS, Azure Key Vault, OAuth 2.0, JWT |

| Continuous Integration / Deployment | Jenkins, GitLab CI/CD, AWS CodePipeline, Azure DevOps |

| Monitoring & Performance | Prometheus, Grafana, Datadog, New Relic |

| Collaboration & Documentation | Jira, Confluence, Slack, Microsoft Teams |

Trusted by Banks and Fintechs Worldwide

Hear directly from banks, fintechs, and wealth managers who have transformed their operations with our custom financial software development. With solutions featuring real-time transaction processing, AI-powered risk analysis, seamless payment integrations, and secure audit trails, they’re achieving greater compliance, faster approvals, and improved customer transparency.

Explore our portfolio to see the impact for yourself!

We transform companies!

Codewave is an award-winning company that transforms businesses by generating ideas, building products, and accelerating growth.

A Network of Excellence. Our Clients.

Frequently asked questions

The timeline varies depending on the complexity, features, and compliance requirements. Typically, a standard financial software takes about 2-4 months from ideation to launch. More complex solutions, including those with integrations and regulatory requirements, can take 6 months or longer.

We prioritize cost optimization by carefully analyzing your business needs to define an optimal feature set and avoid unnecessary functionality. We use an iterative development approach to deliver critical features first, enabling faster ROI. Additionally, we use proven frameworks and ready-made components to simplify development and reduce expenses without compromising quality.

Yes, we offer comprehensive RPA integration tailored for financial software. We automate repetitive tasks, such as loan processing, payment settlements, fraud detection, and compliance reporting, thereby enhancing operational efficiency while reducing errors. Our RPA solutions smoothly integrate with your existing systems to streamline workflows and improve overall productivity.

We integrate robust security practices throughout the development lifecycle. We implement role-based access control and Identity and Access Management (IAM) to protect sensitive data. Regular security audits, vulnerability testing with tools like OWASP ZAP, and adherence to standards such as PCI DSS and GDPR ensure compliance. Continuous monitoring and encryption protocols safeguard your financial data against threats.

Latest thinking

Outdated banking and payment systems holding you back?

Transform Your Finance Infrastructure Now