Sanctioned loans worth $300k/month, scaling to 15 cities

Details about the project

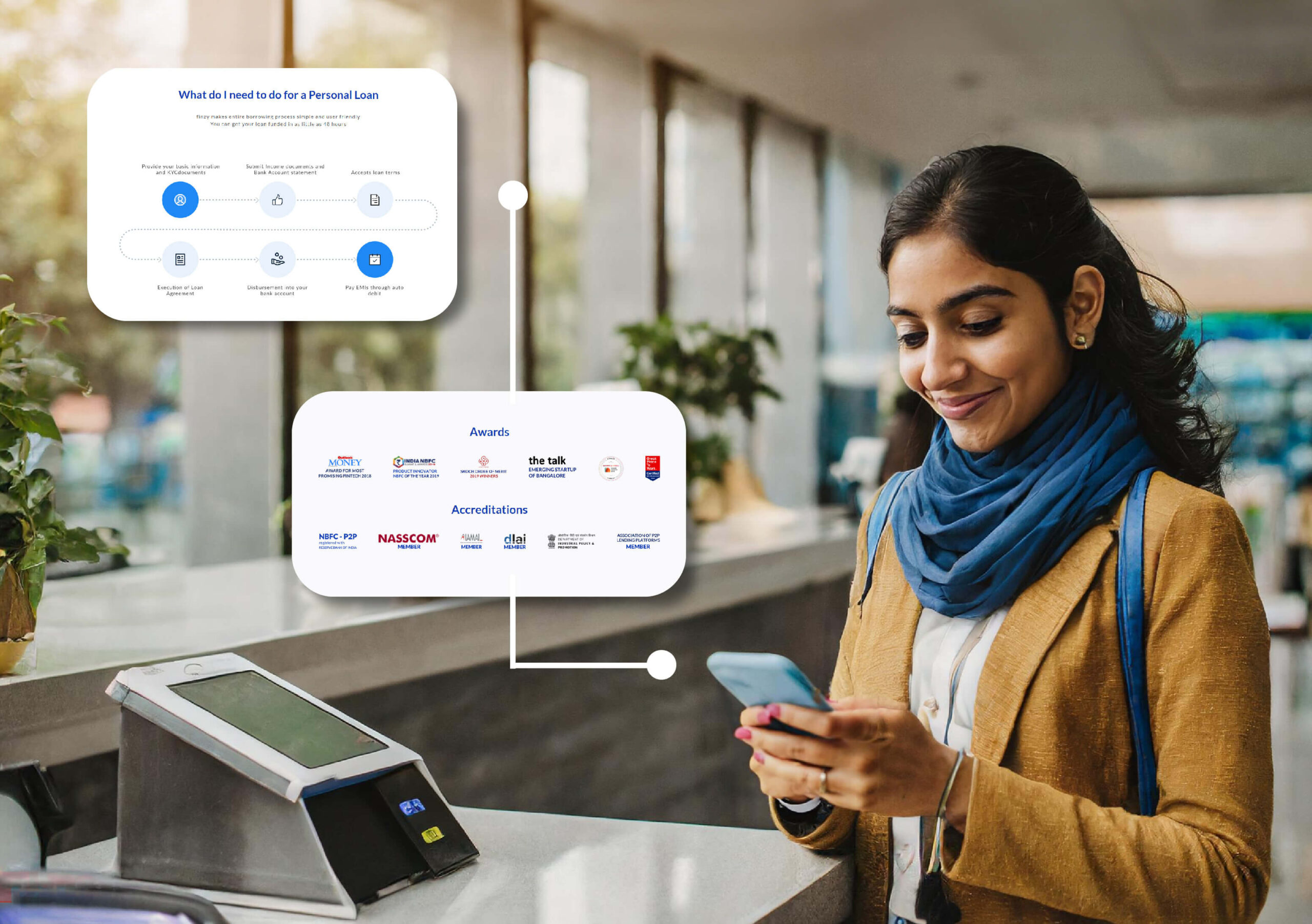

Peer to peer lending for insta-loans

Imagine a cool alternative to traditional bank loans – one that doesn’t involve lengthy approval processes or loan rejections based on past credit card transactions. Codewave built an online peer-to-peer lending platform that offers swift and hassle-free access to loans from individuals, revolutionizing the borrowing & lending experience.

| Date: | January 2024 |

|---|---|

| Year: | 2017-2018 |

| Project: | Digital Innovation |

| Customer: | Finzy |

| Link: | Clutch Review |

Vision: Make Finance Simple & Breezy

A FinTech Startup Finzy, aspired to break down barriers and provide affordable credit access to a broader audience and welcoming more people to lend. They teamed up with Codewave to build a dynamic online platform that not only connects lenders and borrowers, but also streamlines the loan processing journey through a robust administrative system.

Outcomes and impact

Launch to 15 Cities, NBFC Certified

Finzy launched its beta version in 6 months, became an NBFC certified P2P platform and went onto to serving people in 15 cities.

Zero Defaults

The platform achieved a track record of zero defaults, in EMI repayments in the first year, with robust systemic checks and due diligences.

Auto-invest

We architected and engineered finzy to enable automatic investments on behalf of the lender based on their risk apetite, so lenders don’t need to vet borrower profiles manually. The system also learns continuously from borrower behavior and updates credit-scoring.

Credit-scoring

The platform picked up over hundreds of social signals to perform credit scoring and classify the interest range the borrower pays.